Episode 11, Financial Planning Part II

The first part of our little series about finances revealed the insight that a solid financial basis is important and that it can be reached in multiple ways e.g. via owning real estate or investing in the stock market. There are other options (and marrying rich certainly is a good one if you ask me), but these two are most common. The final choice depends on your personal situation and preferences. This time we will tackle the question what a solid financial basis should look like and how to get there. Additionally, we will look at some examples for long-term investments in the stock market.

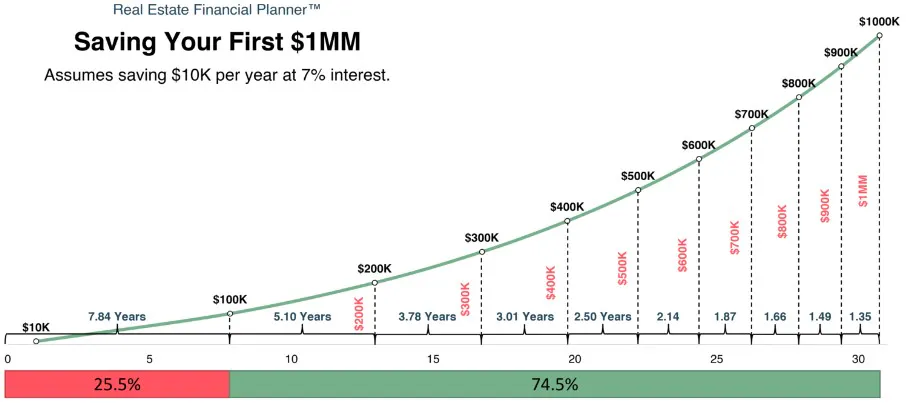

It is certainly clear that a solid financial basis means something different for everyone. Nevertheless, when you invest in the stock market the golden goal is to achieve a portfolio above 100k. I hope that all of you had the opportunity to come across interviews or books of Charlie Munger who passed away in 2023. He oftentimes is solely known as the right hand of Warren Buffet. But listening to him is entertaining as well as enlightening- attributes he shares with this newsletter😉 Mr. Munger has a famous quote: “The first 100k is a bitch, but you gotta do it. I don’t care what you have to do, find a way to get your hands on 100k.” Why is owning 100k so important? Capital scales very well- the more money you have, the more money you will make. Simply put: It takes money to make money. I found an article (Opens in a new window) which describes this very well. Assuming savings of 10k per year with an interest rate of 7%, it takes you roughly 8 years to get to your first 100k. When you already have 100k, it only takes you 5 years to get to 200k. And when you already have 900k, it only takes you 16 months to get to 1million.

What this illustrates is that the share of your investment returns become bigger and bigger. Just think about it: It takes you 16 months to go from 900k to 1million which means that your savings during this time are only about 13k of the 100k. I really think that this is an astonishing insight. I can recommend this simple calculator (Opens in a new window) for an even better illustration. At the end of the previous newsletter, I stated that starting to invest rather late was a waste of money. Let us look at a realistic example, assuming savings of 500 per month at 7% interest rate. You aim to retire with 65 and stop investing at this point in time. When you start investing 500 per month with 35, you will reach about 606k. But when you start investing with 25, you will end up with more than 1,2million when you reach 65. And by the way, your savings only make about 20% of the total sum. All the rest stems from investment returns.

I hope that my little series about finance was interesting to some of you. Please feel free to provide me with feedback so I can plan upcoming topics. Next week we are moving to an easier digestible and entertaining topic. Stay tuned!

Visit Midlife Man (Opens in a new window) to read all previously published episodes.

Please feel free to share and subsribe to my newsletter. Thank you for your support and becoming part of our community!